28 What Happens to Price Level and Gdp if the Federal Reserve Adopts an Easy Money Policy

Monetary Policy: What Are Its Goals? How Does It Work?

What are the goals of monetary policy?

The Federal Reserve Act mandates that the Federal Reserve conduct monetary policy "so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."1 Even though the act lists three distinct goals of monetary policy, the Fed's mandate for monetary policy is commonly known as the dual mandate. The reason is that an economy in which people who want to work either have a job or are likely to find one fairly quickly and in which the price level (meaning a broad measure of the price of goods and services purchased by consumers) is stable creates the conditions needed for interest rates to settle at moderate levels.2

Decisions about monetary policy are made at meetings of the Federal Open Market Committee (FOMC). The FOMC comprises the members of the Board of Governors; the president of the Federal Reserve Bank of New York; and 4 of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis. All 12 of the Reserve Bank presidents attend FOMC meetings and participate in FOMC discussions, but only the presidents who are Committee members at the time may vote on policy decisions.

Each year, the FOMC explains in a public statement how it interprets its monetary policy goals and the principles that guide its strategy for achieving them.3 The FOMC judges that low and stable inflation at the rate of 2 percent per year, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with achievement of both parts of the dual mandate.4 To assess the maximum-employment level that can be sustained, the FOMC considers a broad range of labor market indicators, including how many workers are unemployed, underemployed, or discouraged and have stopped looking for a job. The Fed also looks at how hard or easy it is for people to find jobs and for employers to find qualified workers. The FOMC does not specify a fixed goal for employment because the maximum level of employment is largely determined by nonmonetary factors that affect the structure and dynamics of the labor market; these factors may change over time and may not be directly measurable. However, Fed policymakers release their estimates of the unemployment rate that they expect will prevail once the economy has recovered from past shocks and if it is not hit by new shocks.

How does monetary policy work?

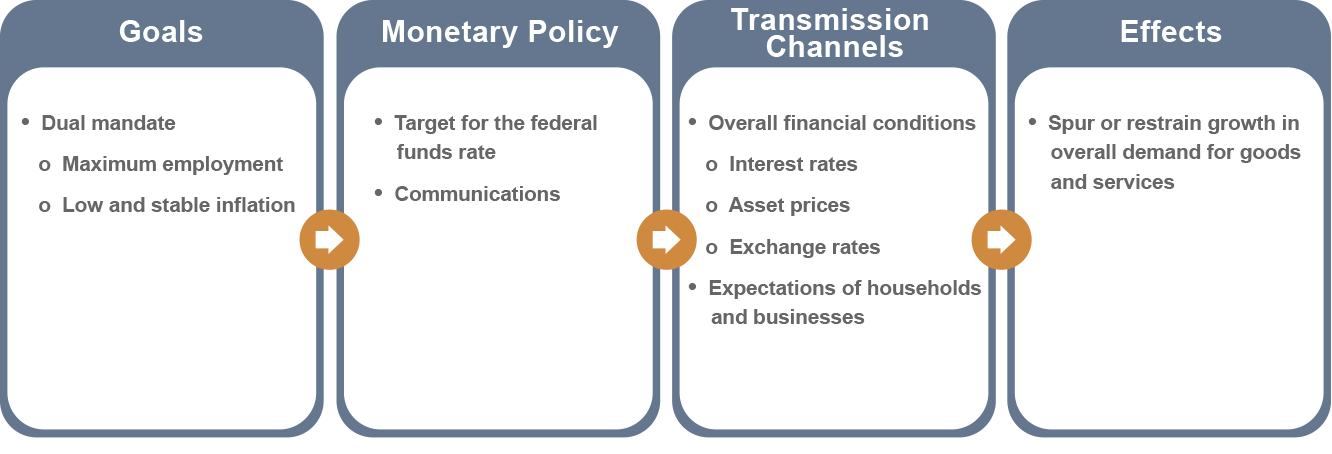

Figure 1 provides an illustration of the transmission of monetary policy. In the broadest terms, monetary policy works by spurring or restraining growth of overall demand for goods and services in the economy. When overall demand slows relative to the economy's capacity to produce goods and services, unemployment tends to rise and inflation tends to decline. The FOMC can help stabilize the economy in the face of these developments by stimulating overall demand through an easing of monetary policy that lowers interest rates. Conversely, when overall demand for goods and services is too strong, unemployment can fall to unsustainably low levels and inflation can rise. In such a situation, the Fed can guide economic activity back to more sustainable levels and keep inflation in check by tightening monetary policy to raise interest rates. The process by which the FOMC eases and tightens monetary policy to achieve its goals is summarized as follows.

Figure 1: The Transmission of Monetary Policy

The federal funds rate

The FOMC's primary means of adjusting the stance of monetary policy is by changing its target for the federal funds rate. 5 To explain how such changes affect the economy, it is first necessary to describe the federal funds rate and explain how it helps determine the cost of short-term credit.

On average, each day, U.S. consumers and businesses make noncash payments--including payments through debit cards, credit cards, electronic transfers, and checks--worth roughly $1/2 trillion.6 To facilitate such payments, banks hold reserve balances at the Fed; payments can be settled by transferring reserve balances between banks.7 Banks also hold these balances to meet unexpected liquidity needs and to satisfy a number of regulatory requirements aimed at ensuring that banks are sound and that their customers' deposits are safe. Banks may borrow and lend reserves to each other depending on their needs and market conditions; as such, banks can use reserve balances both as a means of funding and as an investment. The federal funds rate is the interest rate that banks pay to borrow reserve balances overnight.

The FOMC has the ability to influence the federal funds rate--and thus the cost of short-term interbank credit--by changing the rate of interest the Fed pays on reserve balances that banks hold at the Fed. A bank is unlikely to lend to another bank (or to any of its customers) at an interest rate lower than the rate that the bank can earn on reserve balances held at the Fed. And because overall reserve balances are currently abundant, if a bank wants to borrow reserve balances, it likely will be able to do so without having to pay a rate much above the rate of interest paid by the Fed.8 Typically, changes in the FOMC's target for the federal funds rate are accompanied by commensurate changes in the rate of interest paid by the Fed on banks' reserve balances, thus providing incentives for the federal funds rate to adjust to a level consistent with the FOMC's target.

How changes in the federal funds rate affect the broader economy

Changes in the FOMC's target for the federal funds rate affect overall financial conditions through several channels. For instance, federal funds rate changes are rapidly reflected in the interest rates that banks and other lenders charge on short-term loans to one another, households, nonfinancial businesses, and government entities. In particular, the rates of return on commercial paper and U.S. Treasury bills--which are short-term debt securities issued by private companies and the federal government, respectively, to raise funds--typically move closely with the federal funds rate. Similarly, changes in the federal funds rate are rapidly reflected in the rates applied to floating-rate loans, including floating-rate mortgages as well as many personal and commercial credit lines.

Longer-term interest rates are especially important for economic activity and job creation because many key economic decisions--such as consumers' purchases of houses, cars, and other big-ticket items or businesses' investments in structures, machinery, and equipment--involve long planning horizons. The rates charged on longer-term loans are related to expectations of how monetary policy and the broader economy will evolve over the duration of the loans, not just to the current level of the federal funds rate. For this reason, revisions to the expectations of households and businesses regarding the likely course of short-term interest rates can affect the level of longer-term interest rates. Fed communications about the likely course of short-term interest rates and the associated economic outlook, as well as changes in the FOMC's current target for the federal funds rate, can help guide those expectations, resulting in an easing or a tightening of financial conditions.

In addition to eliciting changes in market interest rates, realized and expected changes in the target for the federal funds rate can have repercussions for asset prices. Changes in interest rates tend to affect stock prices by changing the relative attractiveness of equity as an investment and as a way of holding wealth. Fluctuations in interest rates and stock prices also have implications for household and corporate balance sheets, which can, in turn, affect the terms on which households and businesses can borrow.9 Changes in mortgage rates affect the demand for housing and thus influence house prices. Variations in interest rates in the United States also have a bearing on the attractiveness of U.S. bonds and related U.S. assets compared with similar investments in other countries; changes in the relative attractiveness of U.S. assets will move exchange rates and affect the dollar value of corresponding foreign-currency-denominated assets.

Changes in interest rates, stock prices, household wealth, the terms of credit, and the foreign exchange value of the dollar will, over time, have implications for a wide range of spending decisions made by households and businesses. For example, when the FOMC eases monetary policy (that is, reduces its target for the federal funds rate), the resulting lower interest rates on consumer loans elicit greater spending on goods and services, particularly on durable goods such as electronics, appliances, and automobiles. Lower mortgage rates make buying a house more affordable and encourage existing homeowners to refinance their mortgages to free up some cash for other purchases. Lower interest rates can make holding equities more attractive, which raises stock prices and adds to wealth. Higher wealth tends to spur more spending. Investment projects that businesses previously believed would be marginally unprofitable become attractive because of reduced financing costs, particularly if businesses expect their sales to rise. And to the extent that an easing of monetary policy is accompanied by a fall in the exchange value of the dollar, the prices of U.S. products will fall relative to those of foreign products so that U.S. products will gain market share at home and abroad.

Monetary policy and the 2007-09 Global Financial Crisis

The crisis in financial markets that began in the summer of 2007 and became particularly severe in 2008 led the FOMC to cut its target for the federal funds rate from 5-1/4 percent in mid-September 2007 to near zero in late December 2008. Even after this large cut, the U.S. economy required substantial additional support. However, with the federal funds rate near zero, the Fed could no longer rely on its primary means of easing monetary policy.10

One of the ways in which the FOMC provided further support to the economy was by offering explicit forward guidance about expected future monetary policy in its communications. The FOMC conveyed that it likely would keep a highly accommodative stance of monetary policy until a marked improvement in the labor market had been achieved. Short-term interest rates expected to prevail in the future and longer-term yields on bonds fell in response to this forward guidance.11

Another key monetary policy tool deployed in response to the financial crisis was large-scale asset purchases, which were purchases in securities markets over six years of roughly $3.7 trillion in longer-term Treasury securities as well as securities issued by government-sponsored enterprises. By boosting the overall demand for these securities, the Fed put additional downward pressure on longer-term interest rates. Moreover, as the Fed purchased these securities, private investors looked for other investment opportunities, and, in doing so, they pushed down other long-term interest rates, such as those on corporate bonds, and pushed up asset valuations, including equity prices. These market reactions to the large-scale asset purchases helped ease overall financial market conditions and thus supported growth in economic activity, job creation, and a return of inflation toward 2 percent.12

In December 2015, the FOMC took a first step toward returning the stance of monetary policy to more normal levels by increasing its target for the federal funds rate from near zero. A further step toward normalization occurred in October 2017, when the FOMC began a gradual reduction in its securities holdings. The FOMC has indicated that, going forward, adjustments in the federal funds rate will be the primary way of changing the stance of monetary policy.

Source: https://www.federalreserve.gov/monetarypolicy/monetary-policy-what-are-its-goals-how-does-it-work.htm

0 Response to "28 What Happens to Price Level and Gdp if the Federal Reserve Adopts an Easy Money Policy"

Post a Comment